HOW TO PLAY

Spell and submit words to earn points.

Longer words get point multipliers.

Utilize all your letters for bonus points.

Unused letter points are deducted from your final score.

There is always at least one solution to use all your letters.

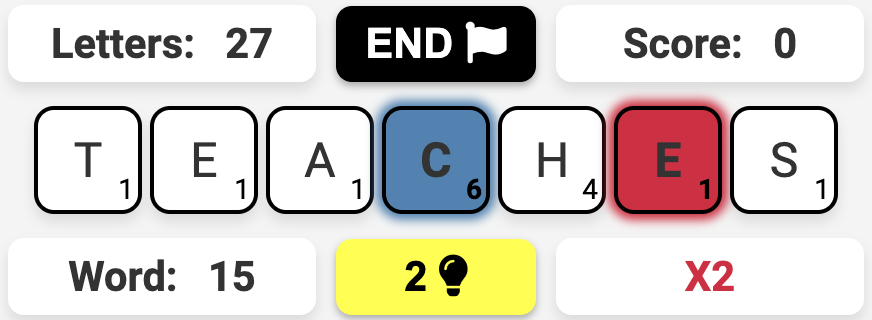

GAME BOARD

Letters: The remaining letters not yet played in the game.

End: A button to end the game early if you choose not to play additional words.

Score: Your current total score in the game.

Word: The score for your current word, before word multiplier.

Clue: A button that reveals a playable word.

Word Multiplier: Indicates how much your word score will be multiplied by.

X: Multipliers impact letter points.

: Returns the letter to you.

: Locks the letter here for the next turn.

: Playing a letter here randomly removes one of your letters.